Electronic Cash Payment System

- E-Cash or Digital Cash is a method that allows buyers to pay for goods or services online by transmitting over the internet a unique electronic number or other identifiers that carry a specific value.

- The user first must have an e-cash software program and an e-cash bank account from which e-cash can be withdrawn or deposited. The user withdraws cash from the account to his computer and spends it on the internet. Theoretically, e-cash can be spent in very small increments, such as Rs.10, Rs.20, Rs.50, etc.

Working of E-cash

1. A customer applies to a bank for e-cash by paying cash or cheque. He requests the banks to issue e-coins in various denominations such as Rs.100, Rs.50, Rs.20, Rs.10, etc.

2. The bank issue e-coins from its currency server. It assigns a random number as ID to each coin. Bank digitally signs each coin with its private key. E-coin has an expiry date also. The bank maintains a database also. The bank maintains a database of all e-coins issued. E-coins are stored by the customer in an e-coin database called e- purse.

3. When the customer buys products online he can pay e-coin from his e-purse. The coin is sent to the merchant using the HTTP protocol to ensure security. At the same time, the customer’s computer marks that coin as spent in its e- purse

4. The merchant sends the e-coin to the bank’s currency server using an SSL connection. The currency server verifies the digital signature in the e-coin. Then the e-coin is accepted and the merchant’s account is credited with the approved amount, after deducting commission.

5. Information is passed on to the merchant, and the merchant, in turn, delivers the goods to the customer.

OR,

Working of E-cash

Advantages of E-Cash

- Lower Transaction Cost

- Convenient

- Authorization not required

- Suitable for small payments

Limitations of E-Cash

- High financial risk as e-cash may be stolen by hackers

- The vendors should have an account in the same bank which issued the e-cash

Electronic Cash Issues

- E-cash must allow spending only once

- Must be anonymous, just like regular currency

- Safeguards must be in place to prevent counterfeiting

- Must be independent and freely transferable regardless of nationality or storage mechanism

- Divisibility and Convenience Complex transaction (checking with Bank)

Two storage methods

Online

- The individual does not have possession personally of electronic cash

- Trusted third party, e.g. online bank, holdsTrusted third party, e.g. online bank, holds customers’ cash accounts

Off-line

- The customer holds cash on a smart card or software wallet

- Fraud and double-spending require tamper-proof encryption

Electronic Cash Security

- Complex cryptographic algorithms prevent double-spending

- Anonymity is preserved unless double spending is attempted attempted

- Serial numbers can allow tracing to prevent money laundering

- Does not prevent double spending, since the merchant or consumer could be at fault

Past and Present E-cash Systems

Checkfree

- Allows payment with online electronic checks

Clickshare

- Designed for magazine and newspaper design for magazine and newspaper publishers

- Purchases are billed to a user’s ISP, who in turn bill the customer

CyberCash

- Combines features from cash and checks CyberCoins Stored in CyberCash wallet, a software storage mechanism located on customer’s computer

- Used to make purchases between .25c and $10

DigiCash

- Allowed customers to purchase goods and services using anonymous electronic cash

Coin.Net- Electronic tokens stored on a customer’s computer is used to make purchases Works by installing a special plug-in to a customer’s web browser

- Merchants do not need special software to accept eCoins.

Millicent

- Developed by Digital, now part of Compaq Electronic scrip system Customers can purchase items of very low value

OR,

What is Ecash?

- Ecash was developed to allow fully anonymous secure electronic cash to be used on the Internet to support online trading between buyers and sellers.

- An electronic cash payment system usually is developed based on an electronic payment protocol that supports a series of payment transactions using electronic tokens or coins issued by a third party

Overview of Ecash:

- Ecash is a payment protocol for anonymous digital money on the Internet.

- It is developed by DigiCash Co, of Amsterdam, The Netherlands.

- It is currently implemented and offered by Mark Twain Bank, St. Louis since 1995.

- DeutscheBank Ag, Frankfurt (Main) offers Ecash as a pilot project to its customers since October 1997.

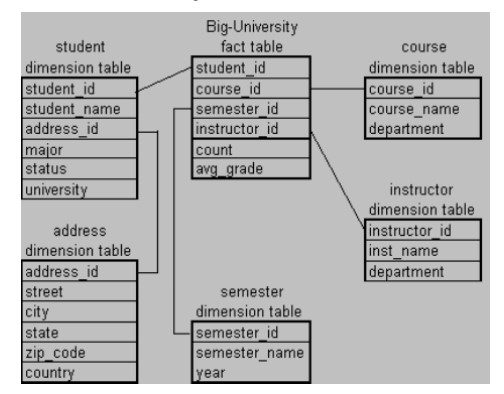

Ecash model:

Three participants are involved in the Ecash payment model:

clients, merchants, and banks.

- clients have Ecash wallet software (cyberwllet) on their computers.

- they can use Ecoins in their wallet to make purchases from merchants.

- withdraw coins from their accounts in an Ecash bank.

- store and manage client’s coins, track all transactions.

- accept and process payments

- interact with Ecash bank to perform validation and authentication

- sell items and generate receipts.

- Banks: clients and merchants have accounts at an Ecash bank.

- manage and maintain accounts of clients and merchants

Basic Requirements for Electronic Cash Payment Systems

Digital money:

Payment systems must provide customers and private households with acceptable

digital money.

- Security:

Ensure the security of transactions and information privacy of users.

- Scalability:

A large number of customers and concurrent transactions should be handled in a scalable manner.

- Efficient and effective:

Payment systems must support efficient and effective payment processing and accounting services for small payment transactions.

- Simple and lost cost:

Payment systems must provide customers with simple and low-cost transparent transactions.

- Anonymous:

Usually, customers wish to stay anonymous for all involved transactions..

- Double spending:

Digital coins consist of a number of bits. Payment systems must be able to recognize and/or prevent repeated payments with the same digital coin.

- Exchange:

Digital money should be convertible into “real” money whenever necessary.

- Store:

Digital money must be stored locally on hard disks or other media.

- Value:

Digital cash payment systems must provide a large number of digital coins for circulation and perform authentication checking.

Advantages of Electronic Cash Payment Systems

Saved time:

- Reduce transaction process time

- Speed up transaction processes

Reduced costs:

- Reduce transaction costs

- Reduce cash distribution costs

Flexibility:

- Digital cash can take many forms, including prepaid cards

- Digital cash can be converted into different currencies

Reduce cash distribution risk:

- Reduce the regular cash distribution risk

- Error-free and efficient:

- Reduce transaction errors

Features of electronic cash:

- Portable, divisible, recognizable, untraceable, and independent from physical locations.

Important features of electronic cash payment protocols and systems:

- Anonymity: This ensures that no detailed cash transactions for the customer are traceable. Even sellers do not know the identity of customers involved in the purchases.

- Liquidity: Digital cash has to be accepted by all concerned economic agents as a payment method.

- Prepaid cards: Buyers can buy prepaid cards that are accepted by special sellers.

- Electronic payment processing: all transactions are processed electronically

Transactions Types in Electronic Cash Payment Systems

Three types of transactions:

- Withdrawal: the payer transfers some of the money from the bank account to his or her payment card.

- Payment: the payer transfers the money from the card to the payee.

- Deposit: the payee transfers the money received to the bank account.

Two types of implementations:

- Online payment: --> the merchant calls the bank and verifies the validity of the consumer’s token or electronic coin before accepting the payment and delivering the merchandise.

- Off-line payment: --> the merchant submits the consumer’s payment for verification and deposit sometime after the payment transaction is completed.

Comments

Post a Comment