What is e-payment? Describe the working mechanism of online credit card transaction.

E-payment

An e-payment system is a way of making transactions or paying for goods and services through an electronic medium, without the use of checks or cash. It's also called an electronic payment system or an Online payment system.

Pros:

- Potential for great flexibility

- Low transaction costs

- Rapid and diverse purchase power

How online credit card transaction works

Some information about How online credit card transaction works

- Processed in much the same way that in-store purchases are

- The major difference is that online merchants do not see or take an impression of a card, and no signature is available.

- Participants include consumer, merchant, clearinghouse, merchant bank (acquiring bank), and consumer’s card issuing bank

Five parties involved in this transaction

a) Consumer

b) Merchant

c) Clearinghouse

d) Merchant bank

e) Issuing bank

Step 1:- When the customer wants to pay, a secret tunnel through the internet is created using SSL, and credit card information is sent to the merchant

Step 2:- Once the credit card information is received, the merchant contacts a clearinghouse

Step 3:- The clearinghouse requests the issuing bank to authenticate and verify the customer account balance

Step 4:- Issuing bank credits merchant account

Credit Card E-commerce Enablers ( Internet Payment Service Provider)

- Provides merchant a secure merchant account

- Provides payment processing software installed on merchant’s site

- collects transaction information from merchant’s site

- routes the transaction via VeriSign ( Internet security service provider) payment gateway to the appropriate bank

- ensures a customer is authorized to make a purchase

- funds transferred to a merchant account

Limitations of Online Credit Card Payment Systems

- Security – neither the merchant nor consumer can be fully authenticated

- Cost – for merchants, around 3.5% of the purchase price plus a transaction fee of cents per transaction

- Social equity – many people do not have access to credit cards (young adults, plus almost 100 million other adult Americans who cannot afford cars or are considered poor risk)

- Credit cards are the dominant form of online payment.

- Credit cards account for 55 percent of online payments in the United States and about 50 percent of online purchases outside the United States.

- Online credit card transactions are processed in much the same way that in-store purchases are, with the major differences being that online merchants never see the actual card being used, no card impression is taken, and no signature is available. These types of purchases are also called CNP (Card Not Present) transactions.

- The major difference is, since the merchant never sees the credit card, nor receives a hand-signed agreement to pay from the consumer when disputes arise, the merchant faces the risk that the transaction may be disallowed and reversed, even though he has already shipped the goods or the user had downloaded a digital product.

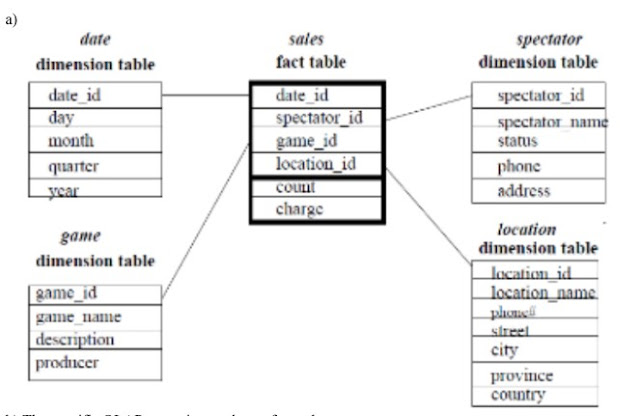

- There are 5 parties involved in an online credit card purchase:

- To accept payments by credit card, online merchants must have a merchant account established with a bank or financial institution.

- A merchant account is simply a bank account that allows companies to process credit card payments and receive funds from that transaction.

- Companies that have a merchant account still need to buy or build a means of handling the online transaction; securing the merchant account is only step one in a two-part process.

- The second step is the Internet payment service provider (Clearinghouse) who provides the software for online credit card transaction processing.

- For example, Authorize.net is an Internet payment service provider. It helps a merchant secure an account with one of its merchant account provider partners (usually Merchant Bank), and then provides payment processing software for installation on the merchant's server.

- The software collects the transaction information from the merchant’s site and then routes it via the Authorize.net “payment gateway” to the appropriate bank (customer bank), ensuring that customers are authorized to make their purchases. Then funds for the transaction are transferred to the merchant’s bank account.

- Neither the merchant nor the consumer can be fully authenticated if SSL is not implemented by CA’s authority.

- SSL provides only merchant’s verification but not a client (it's optional)

- SET provides two-way authentication, but it's difficult to implement by merchant and client because to much complex.

- Repudiation: Consumer can repudiate online transaction.

- Cost – Transaction fee is charged from the merchant.

- Social equity – Millions of customers do not have credit cards.

Comments

Post a Comment